While lower mortgage rates have reinvigorated hope for the stalling housing market, 2025 might not wind up much better than 2024.

Sure, lower interest rates boost affordability, but there are other components to a home purchase that remain cost-prohibitive.

Whether it’s simply an asking price that’s out of reach, or rising insurance premiums and lofty property taxes. Or other monthly bills that eat away at the housing budget.

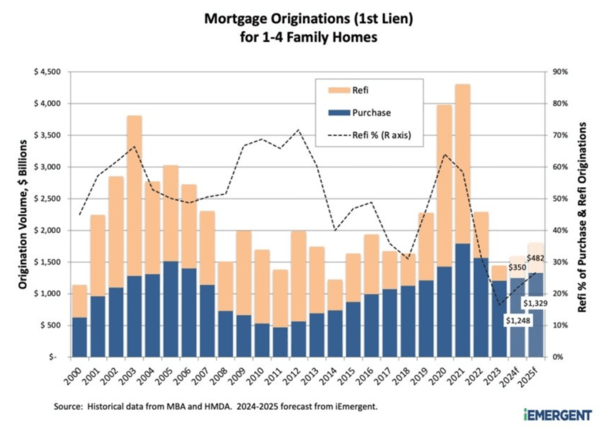

This explains why mortgage origination forecasts for purchase lending continue to be pretty dismal.

However, the emerging trend of rising mortgage refinance volume should get stronger into 2025.

2024 Purchase Volume Has Been Revised Down

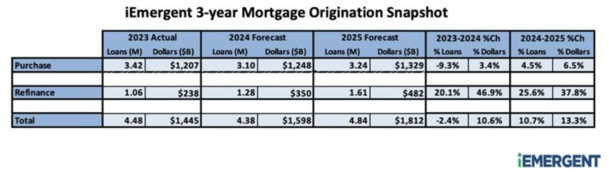

A new report from iEmergent revealed that 2024 purchase mortgage originations are projected to fall in terms of loan count when compared to 2023.

In other words, despite lower mortgage rates, the number of home purchase loans is now expected to fall below 2023 levels.

However, thanks to an increase in average loan size, the company believes purchase loan volume will still see a modest increase of 3.5% year-over-year.

To blame is still-high mortgage rates, which peaked about a year ago and have since fallen nearly two percentage points.

But home prices remain elevated, and when combined with a 6% mortgage rate and steep insurance premiums and rising property taxes, the math often doesn’t pencil.

Adding to affordability woes is the continued lack of existing home supply. There simply aren’t enough homes for sale, which has kept prices high in spite of reduced demand.

Refis Expected to Jump Nearly 50% from 2023 Lows

On the other side of the coin, mortgage refinances are finally showing strength thanks to that pronounced decline in mortgage rates.

They bottomed in late 2024 when the 30-year fixed hit the 8% mark, with only a handful of cash out refinances making sense for those in need of payment relief (on other debt).

But since then rate and term refinances have picked up tremendously as recent vintages of mortgages have fallen “into the money” for monthly payment savings.

As noted a week ago, rate and term refis surged 300% in August from a year earlier and the refinance share of total loan production rose to 26%, the highest figure since early 2022.

Chances are it will continue to grow into 2025 as mortgage rates are expected to ease further this year and next.

iEmergent said they “expect rates to finally start declining in the months ahead,” on top of the near-2% decline we’ve already seen.

While many have argued that the rate cuts are mostly baked into mortgage rates already, which explained mortgage rates rising after the Fed cut, there’s still a lot of economic uncertainty ahead.

The 50-basis point came as a surprise to many and another one could be on deck for November, currently holding a 60% probability per CME FedWatch.

If it turns out the Fed has gotten behind the eight ball, 10-year bond yields (which track mortgage rates) could drop more than is already penciled in.

At the same time, there’s still room for mortgage spreads to compress as the market normalizes and adjusts to the new lower rates (and higher loan volumes ahead).

2025 Refinance Volume Slated to Rise Another 38%

Looking forward to 2025, the refinance picture is expected to get even brighter, with such loans rising a further 38% (in dollar amount) from 2024.

This will likely continue to be driven by rate and term refis as interest rates continue to improve and the millions who took out loans since 2022 take advantage of cheaper rates.

But it could also come in the form of cash out refinances, which will become more attractive as well.

Even if an existing homeowner has a rate of say 4%, something in the high-5s or low 6% range could work if they need cash.

This could be a reflection of increasing debts in other departments, as pandemic-era savings run dry.

Ultimately, homeowners have barely touched their equity this housing cycle, so there’s an expectation that it’ll happen at some point, especially with home equity at record highs.

You might also see this in the form of second mortgage lending, with HELOC rates expected to fall another 2% as the prime rate is lowered by that same amount over the next 12 months.

Meanwhile, iEmergent is forecasting a paltry 6.5% increase in purchase volume in 2025, pushing overall dollar volume growth to just 13.3%

As for why purchase lending is projected to be relatively flat next year, it’s a wider economy story.

If economic growth continues to decelerate and a recession takes place, a weaker labor market with higher unemployment could dampen home buyer demand.

So even if mortgage rates decline more as a result, you’ve got fewer willing and able buyers, despite lower monthly payments.

This explains the phenomenon of how home prices and mortgage rates can fall in tandem.

They might not, but it at least debunks the idea of there being an inverse relationship between the two.

Long story short, 2025 should be better for mortgage originators thanks to refis, but don’t get your hopes up on purchase lending seeing a big jump thanks to lower rates.