In the mortgage rate world, it’s sometimes a game of inches.

This can be true for both prospective home buyers and existing homeowners looking for rate relief.

Granted, if you’re that marginal when it comes to affording a home, maybe you should consider renting until it’s a little more decisive.

But if you already own a home and hold a high mortgage rate, the next six months or so could make or break your refinance opportunity.

Lately, mortgage rates have retraced from their recent lows of just over 6%, returning to levels around 6.625%.

As a result, many millions of homeowners are no longer “in the money” for a refinance. But that could change in an instant, just as it already has.

Are Current Mortgage Rates at Least 0.75% Below Your Rate?

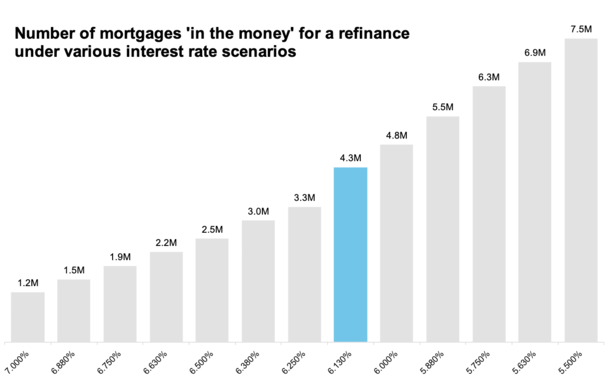

A new report from ICE revealed that the refinance population climbed to over 4.3 million thanks to the rally in rates that came to an abrupt end, ironically after the Fed cut rates.

At that time, the 30-year fixed mortgage was averaging around 6.125%, down from nearly 7% as recently as late July.

That meant the refinanceable population had surged from around 1.2 million to 4.3 million in a matter of less than two months.

Of these 4.3M, a whopping 65% received their mortgages over the past two years, including 1.4M in 2023 and 1.3M this year. So that whole date the rate, marry the house thing could actually pan out.

ICE considers a homeowner “in the money” for a rate and term refinance if their existing mortgage rate is at least 0.75% below prevailing market rates.

So basically any borrower with a 7%+ rate would have met that definition in mid-September.

But today it’s only the borrowers with mortgage rates around 7.5% that would benefit from a refi.

If you want to get more into the nitty-gritty, highly-qualified refinance candidates should have a 720+ FICO score and a loan-to-value ratio (LTV) of 80% or less.

Of course, conditions can change quickly. And as I wrote the other day, mortgage rates don’t move up or down in a straight line.

Meaning the recent uptick could just be a temporary hiccup and short-lived. Mortgage rates saw periods of relief on the way up. They could just as well see periods of pain on the way down.

The Refi Boom Depends on Rates Continuing Lower Into 2025

As you can see, even minimal rate changes can impact millions of homeowners looking for payment relief.

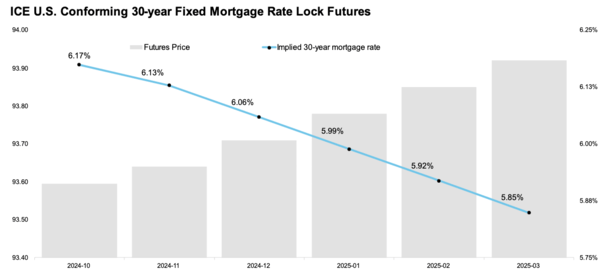

The good news is ICE expects 30-year fixed mortgage rates to continue coming down into the last months of the year and 2025. For the record, I agree with them.

Their latest estimate, calculated using the single-day spread between the loan balance weighted average APR futures price and simple average daily rate, has the 30-year down to 5.85% by March 2025.

Granted it also has the 30-year fixed at 6.17% for October 2024, so some recent adjustments may have not been captured by their time-sensitive report.

But as noted, it’s good to zoom out anyway, and pay less attention to the day-to-day or even week-to-week noise.

A lot can happen in a few days, and we’ve got two big reports coming tomorrow and Friday, the CPI report and PPI report.

Both could push rates back onto their downward trajectory. They could also push rates higher…

If ICE’s predictions hold true longer-term, there will be a nice little refi boom for loan officers and mortgage brokers in early 2025.

Rates may also approach that so-called magic number of 5.5%, at which point you’d get more home buyers entering the market too, perhaps just in time for spring.

This is the bullish case for the mortgage market, but still very much up in the air. You can see just how fickle it all is with even a .125% or .25% difference in rate potentially affecting millions.

Read on: The refinance rule of thumb.