Capfin Lender Guide

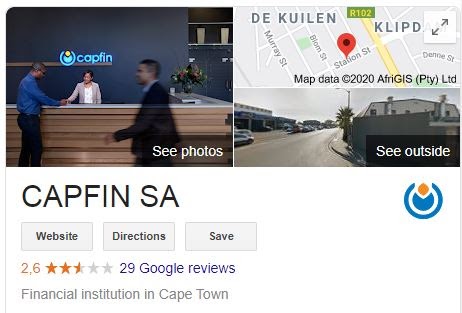

Capfin is one of South Africa’s fastest growing independent credit providers.

Customers have the option of applying for a loan online or at one of Capfin’s retail affiliate stores – Ackermans or Pep. This has opened up its market considerably, as it has made loans more easily available to those who don’t have access to the internet.

Capfin is a division of Century Capital (Pty) Ltd, which is also a registered credit provider.

- Founded: 2010, Capfin SA Pty Ltd

- No. of Staff: 501 – 1000

- Location: Headquartered in Cape Town

- Valid Lending Licence: Registered Credit Provider (NCRCP4536)

Loan Products

Capfin offers loans up to the value of R50 000, depending on an individual’s affordability outcome. The assessment considers factors such as income and expenses, credit profile and payment behaviour.

Loan Amounts Available

An individual can apply for a loan from R500 to R50 000.

Loan Terms Available

Capfin offers short-term loans for 1 month, 6 months, 12 months, and 24 months. The available term options would depend on the amount of the loan applied for.

Interest and Fees

The interest rate and fees vary depending on the amount and the duration of the loan agreement. For example:

- A R4000 loan taken over 6 months would be broken down as such:

- Maximum interest rate: 5% per month

- Initiation fee: R530

- Maximum monthly service fee: R68

- Maximum monthly installment: R932 per month

- Maximum loan repayment of R5 591

- An R8000 loan to be taken over a 12 month period would be structured as follows:

- Maximum interest rate: 28 % per annum

- Initiation fee: R986

- Maximum monthly service fee: R68

- Maximum monthly installment: R911 per month

- Maximum loan repayment of R10 930

Repayments

Repayments are structured around the individual’s regular salary date. When applying for the loan, select the date that your salary is paid.

Late Fee

For late payments, Capfin will charge the interest rate applicable to the amount in arrears. However, that shall not exceed the maximum interest rate that was signed for in the loan agreement.

Should an individual be going through a rough patch and be potentially unable to make their monthly payments, the company’s collections department is flexible and will allow an alternative arrangement to be made. It’s best to do this at least a week before the payment is scheduled to come off the account.

How To Apply For a Loan

Applying through Capfin is simple, as well as being accessible to thousands nationwide who may not be able to apply online.

For individuals who apply at the retail outlets, all documents will be scanned and uploaded to the Capfin system, by a designated employee assigned to assist with this specifically.

Another great feature is the ability to apply for a loan via sms.

Minimum Criteria to Take a Loan

To qualify, you will need to have the following:

- A valid South Africa ID

- Your 3 latest payslips or 3 latest bank statements

- Proof of permanent employment

- A working cell phone number

- A valid SA bank account

- Must be 18 years or older

Information Required for Application

- ID number

- Employment information

- Monthly income

- Expenses

- Bank account information

How Long Will It Take?

The application process is quick and painless. It does take up to 48 hours for the verification processes and approvals before the money is paid out, but once approved the payment is prompt.

Support Team Contact

Capfin has tried to streamline this process as much as possible by giving their customers access to their accounts via a self-help login. This allows you to track your payments, manage missed payments, and reschedule payments online.

The also have a self-service channel on *134*6454#, which is at no extra charge to customers.

Clients who would prefer to speak to a real person can contact the call centre, where an operator will assist.

- Phone: 087 354 0000

Available Monday to Friday, 08:00 to 18:00, Saturday & Sunday, 08:00 to 13:00 - Website: www.capfin.co.za

Social Media

Customer Reviews

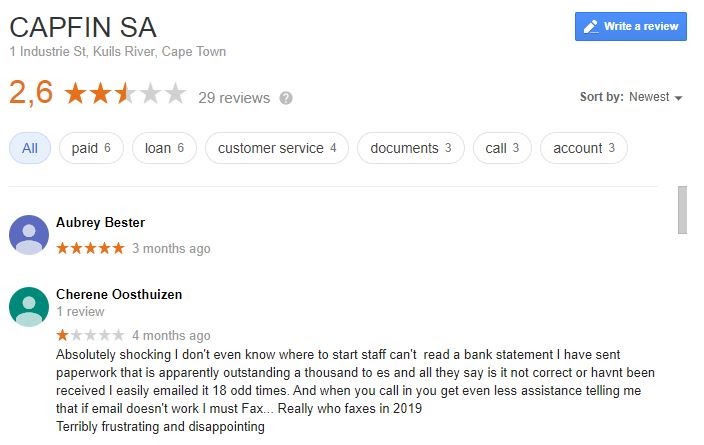

The company has received 29 ratings on Google Reviews, which average out to 2,6 stars.

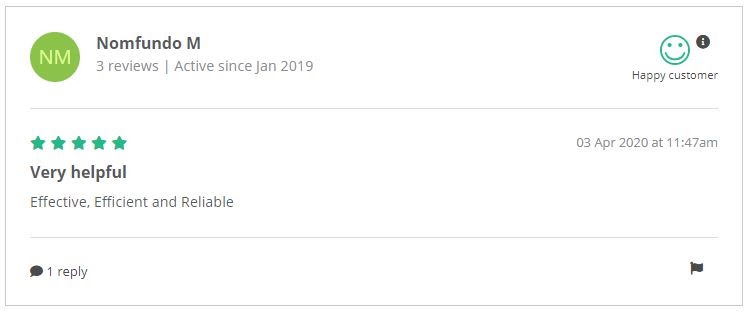

Reviews are extremely diverse, with most recent ratings swinging from 5 stars to 1 star. Their rating suggests that there is an even split between satisfied and dissatisfied customers.

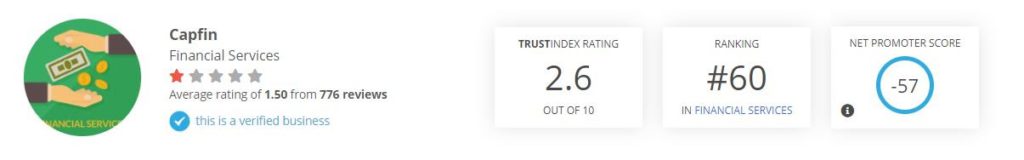

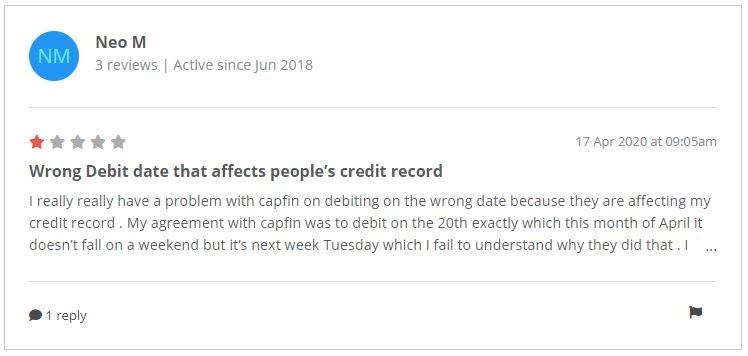

HelloPeter

Unfortunately, Capfin’s rating on HelloPeter is even lower than Google, coming in at 1,5 out of 5.

Once again, there is some variation in feedback, but the majority of recent reviews show extreme dissatisfaction.

Average Star Rating:

We’ve calculated the average between Google Reviews and HelloPeter ratings.

Capfin’s average rating between these two is 2,05 stars out of 5.