Did you know that over 20% of new businesses fail during the initial two years of commencement? What’s even more alarming is that 45% of businesses fail to achieve their objective in the first 5 years and only around 25% of them last for over 15 years. One of the most important reasons related to business failure is lack of capital and funds. Most businesses fail to gather money to meet their business expenses punctually.

This is especially true for small businesses and bootstrapped start-ups that often have limited capital and financing sources. Business Loans offer a great alternative to address such situations.

What is a Business Loan?

A business loan can be simply defined as credit that is specially designed to help businesses that require financial aid. It can be used to meet immediate business expenses that could range from buying equipment to paying salaries and other bills.

It can also be used to expand your operations across different geographies. A business loan can be categories under two segments, i.e. Long term business loans and short-term business loans.

Long term loans are mostly used for project financing, this can range from modernisation of existing facilities to acquisition of capital goods or services. Short term business loans are usually taken to finance the working capital requirements and are usually repaid within a year. Long term loans have a higher loan tenure and are usually repaid over a long period.

There are no restrictions imposed on how the funds will be used when you are opting for a business loan from reputed institutions like Clix Capital. The only obligation is that it should be used to advance business-related activities.

Important Considerations for a Business Loan

Business loans can be a boon for organisations during financially challenging times. It can help businesses to grow their operations and expand into different territories. Here are some important considerations that you must be mindful of before getting a business loan in India.

1. Figure out the purpose of your business loan

It is important to ascertain what you need the business loan for. The purpose of taking a business loan should be clear as day. Knowing what you need the loan for and how it will benefit your business is important before applying for any loan.

Most businesses take a business loan for different purposes, including buying inventory, renting a new place for business operations, hiring new talent, marketing expenditure, utilities, buying machinery or other assets, etc.

2. Learn about the actual cost of getting a business loan

You must understand that taking a business loan is a big commitment and you have to repay the loan within a limited period. Computing the cost of your business loan is very important to manage your business expenses effectively. You must enquire about the exact rate of interest your lender will be charging on these loans. Besides this, you should also calculate your business EMI in advance.

3. Decide the exact business loan amount that you need to borrow

When you have figured out why exactly you need the business loan, it is time to get an estimate regarding the exact amount you will need to borrow through a loan. Your business might be eligible for a higher loan amount, but if it’s unnecessary to borrow, refrain from doing the same. Borrowing too little or borrowing too much can put you in the wrong place. Therefore, it is important to evaluate the amount of money you need to manage your business expenses.

4. Research and compare the borrowing alternatives

There are many ways to get a business loan and each has its pros and cons. It is important to conduct your research about the business loans being offered by different companies and find one that best suits your needs. Clix Capital is among the industry leaders in the Indian lending space that offers customized loan solutions for a wide range of business activities.

5. Document requirements for availing of the loan

You must be aware of all the documents that you need to submit during the business loan process. Any missing document can lead to the rejection of a loan application when it comes to a business loan. Financial institutions that are offering a collateral-free loan are majorly concerned with the documents submitted by the applicant. While processing business loan applications, most lenders usually look for the balance sheet of the company, profit and loss account, cash flow statements, tax audit reports, etc. Some financial institutions might also ask you to submit the current year’s business performance reports.

Also Read: Important Documents Required Before Applying for Your Business Loan in 2023

Benefits of Getting a Business Loan

Some of the most prominent business loan benefits are listed below.

1. Flexibility in the usage of funds

When you are availing of a business loan, you have full flexibility in how it should be used to advance your business activities. You have full control over how you want to allocate the capital obtained through a business loan. You can use it for a wide range of activities related to business, including financing your working capital needs, paying rent and salary, buying machinery, etc.

2. No division of profits

Another important business loan benefit is that there is no division of profits and you have complete ownership of your business. It is better than giving up equity to investors for capital if you want to keep all your profits.

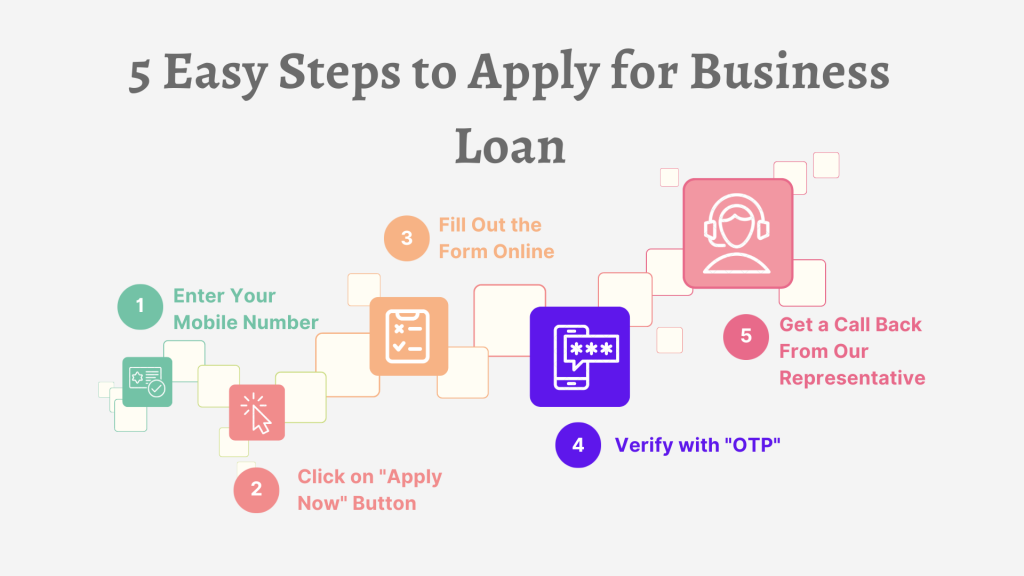

Business Loan Application Process with Clix Capital

The disbursal process is quick and requires minimal documentation for the loan processing. The best thing is that you can get up to INR 50,00,000 business loans without any collateral from Clix Capital!

For any queries, find us on Facebook, Instagram, LinkedIn, Twitter, or WhatsApp. You can also reach us at hello@clix.capital.com or call us at +91-120-6465400.T&C Apply*.