Our monthly construction industry trend report combines the latest industry data with our internal findings from National Business Capital’s award-winning team. With extensive experience in the construction industry since 2007, we are thrilled to share these findings and expand on them through our unique expertise.

Our goal is to provide business leaders and decision-makers with the necessary information and data to make well-informed decisions in their business endeavors.

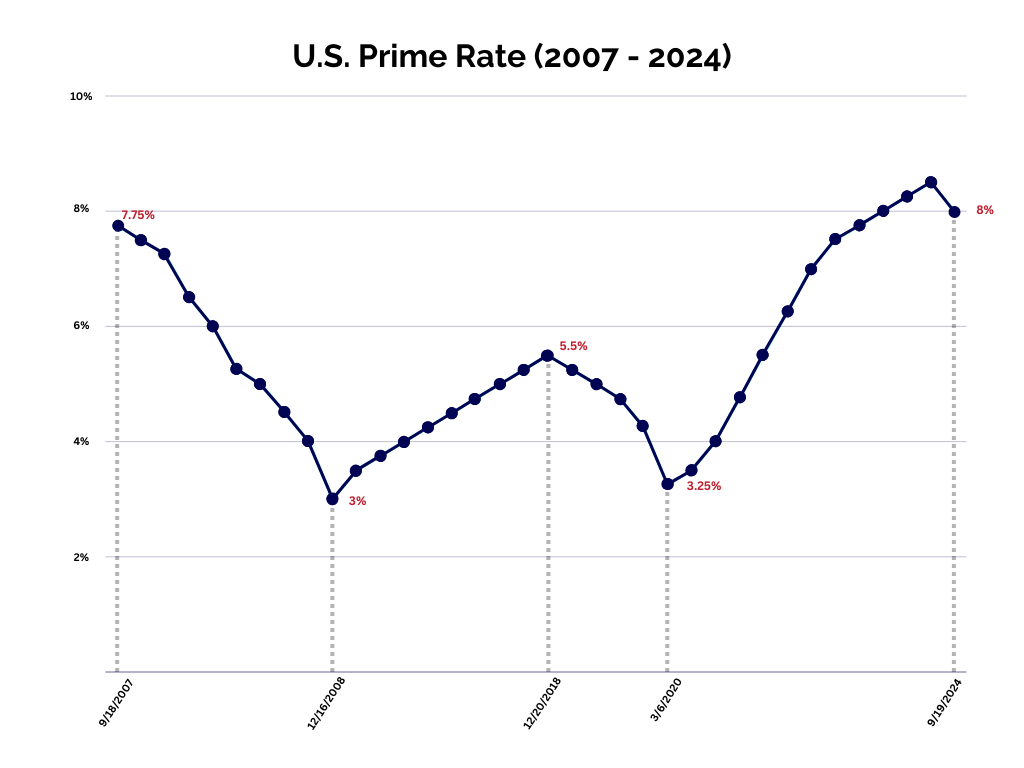

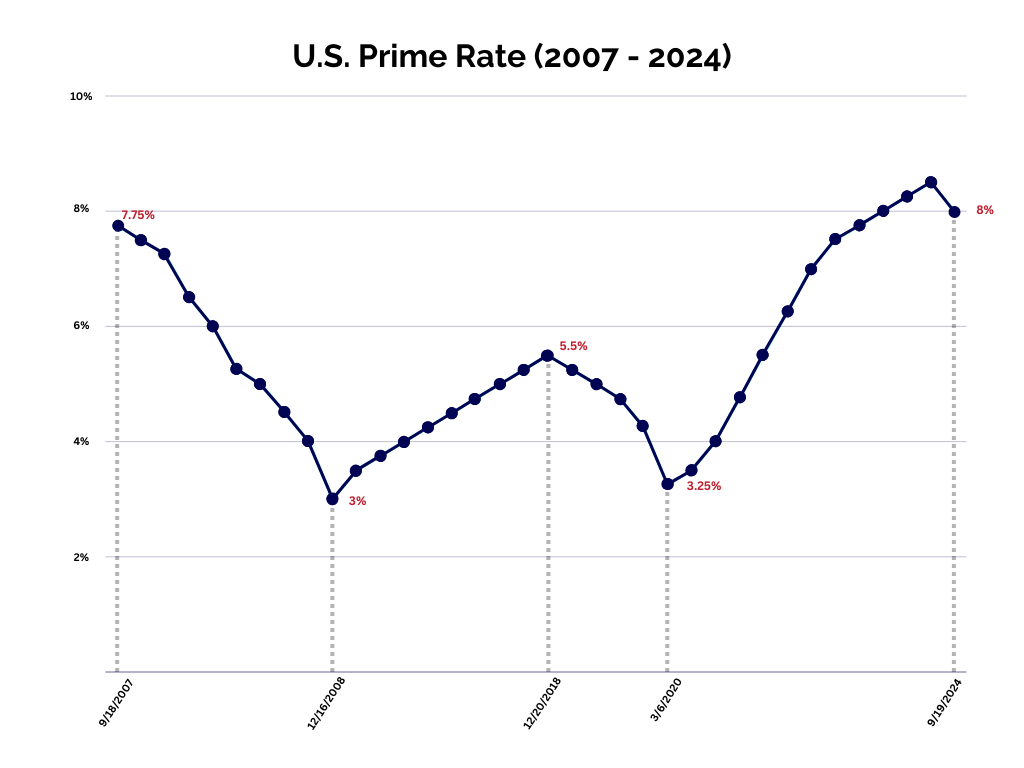

The Federal Reserve Cut the Prime Rate by 50 Basis Points

Data provided by J.P. Morgan Chase

September 2024 – On September 19th, the Fed lowered the prime rate by 50 basis points from 8.5% to 8%. This move signals that their fight against the runway inflation that plagued the economy post-Covid has progressed and that the economy is ready to rebound.

The rate cut also marks the end of a three-year-long tightening cycle, where the prime rate reached its highest point since 2001. As the prime rate falls, the cost of capital will become less expensive and restrictive for the construction community and other industries.

Access to lower-cost capital can spur construction activity across the country. With access to working capital, equipment loans, and more, construction companies can purchase necessary materials, hire specialized workers, and operate at peak performance with new equipment and tools. We believe this will likely grow construction revenue considerably over the next 2-5 years.

Considering that a lack of access to capital has hampered the construction industry, the Fed’s decision is good news for the community. When construction companies can leverage capital from outside their cash flow, they can make larger bids on projects, qualify for more substantial jobs through infrastructure investments, and streamline the day-to-day operations to finalize projects – and collect profits – promptly.

Still, it’s worth arguing whether it’s the cart leading the horse. Many economists use construction activity as a lagging metric of economic health, so it’s important to note that a rate cut in itself won’t immediately spur construction activity. Instead, it returns confidence to the market, which should raise demand for construction projects by making them more attractive and feasible for business decision-makers.

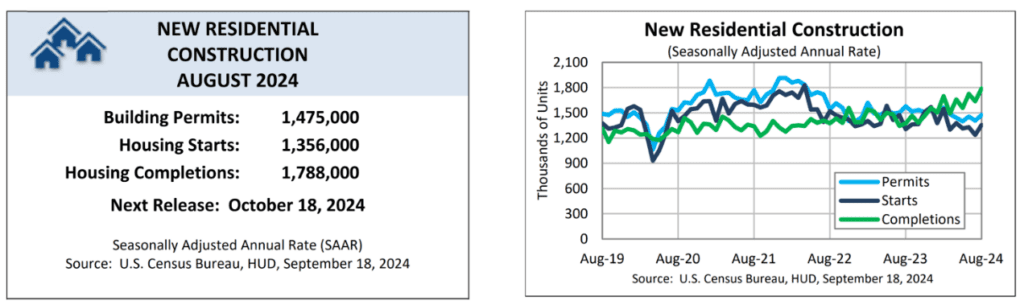

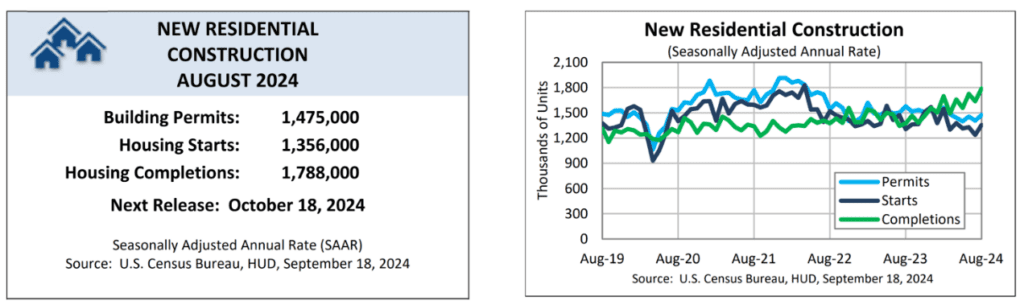

Rate Cuts x Residential Construction

Another aspect of the rate cut construction companies should consider is how it affects the housing market. Since the Fed cut rates less than a month ago, we can only forecast with historical data.

Source: Census.gov

September 2024 – The most recent available data – August 2024 – suggests that permits and starts are trending downward while completions are the opposite. Given the uncertainty of the market heading into election season, it’s likely that permits and starts are lagging because decision-makers are waiting for a more certain climate.

Looking ahead, though, rate cuts can spark changes in housing market activity. As mortgage rates fall, homeowners may consider capitalizing on the inflated housing market by selling. With more available supply, we believe this will break apart the gridlock that’s hindered housing market activity.

Both seasoned and first-time home buyers will take advantage of the new inventory and, before long, start to invest in their assets with renovations. Renovation work will see a major increase in demand as this trend progresses, although performance will depend on material pricing.

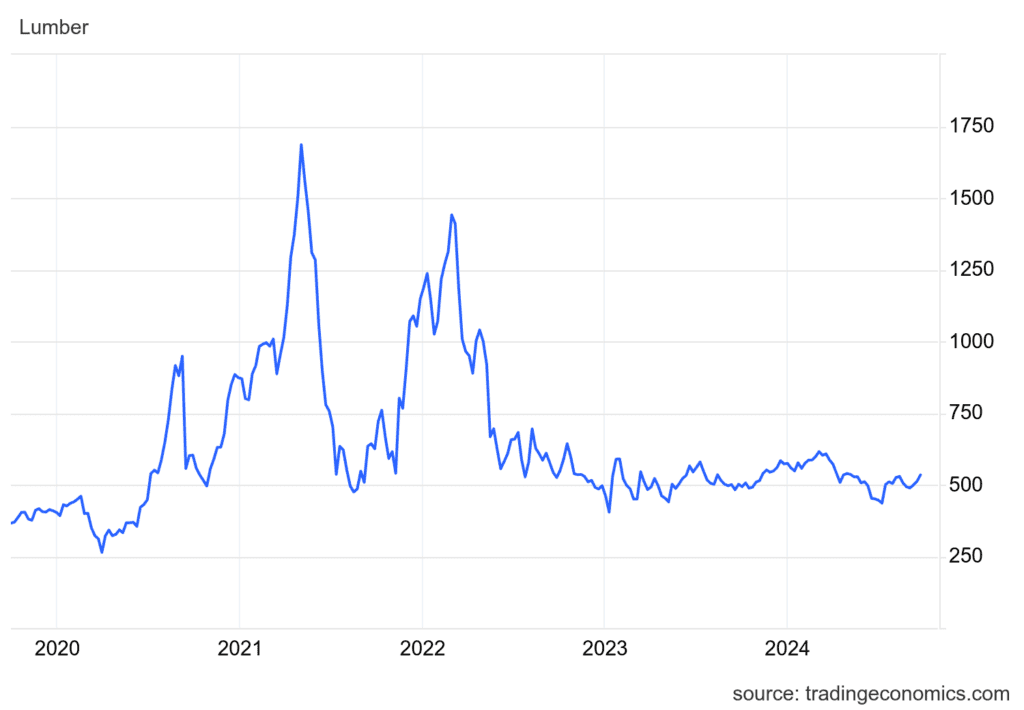

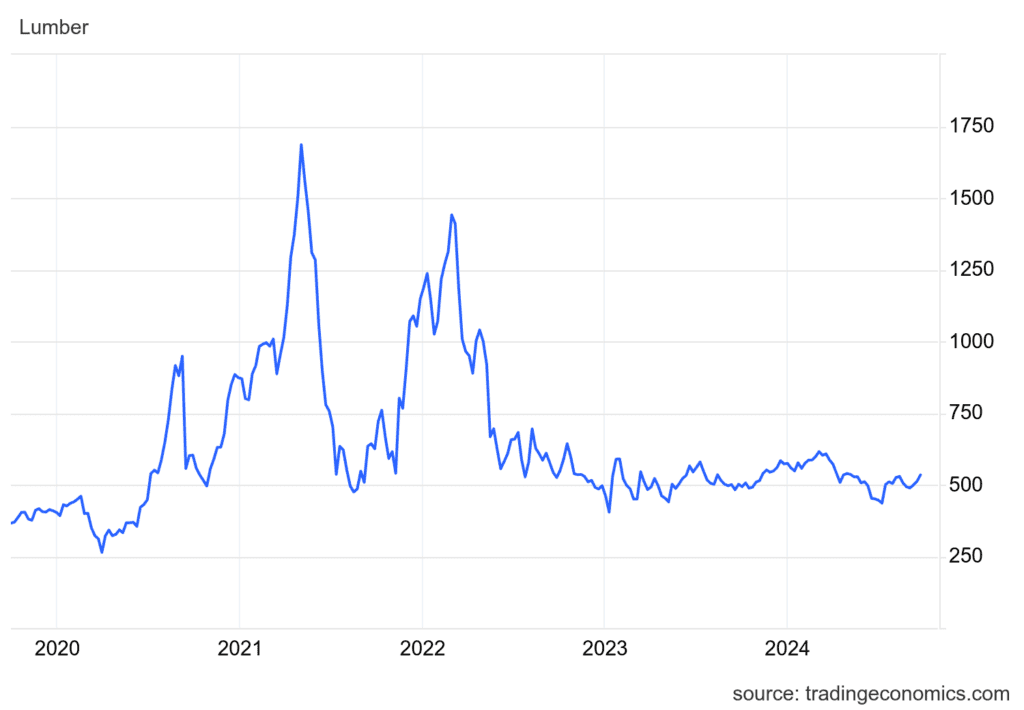

Lumbar Costs (2020-2024)

*Years by USD/1,000 Board Ft.

Source: TradingEconomics.com

Lumbar, one of the key materials across many construction sectors, has seen significant volatility over the last five years, most notably from 2020 to 2022, when prices spiked considerably.

We’ve seen some softening in prices since then. Recently, however, we’ve seen a 21.1% increase in lumbar costs.

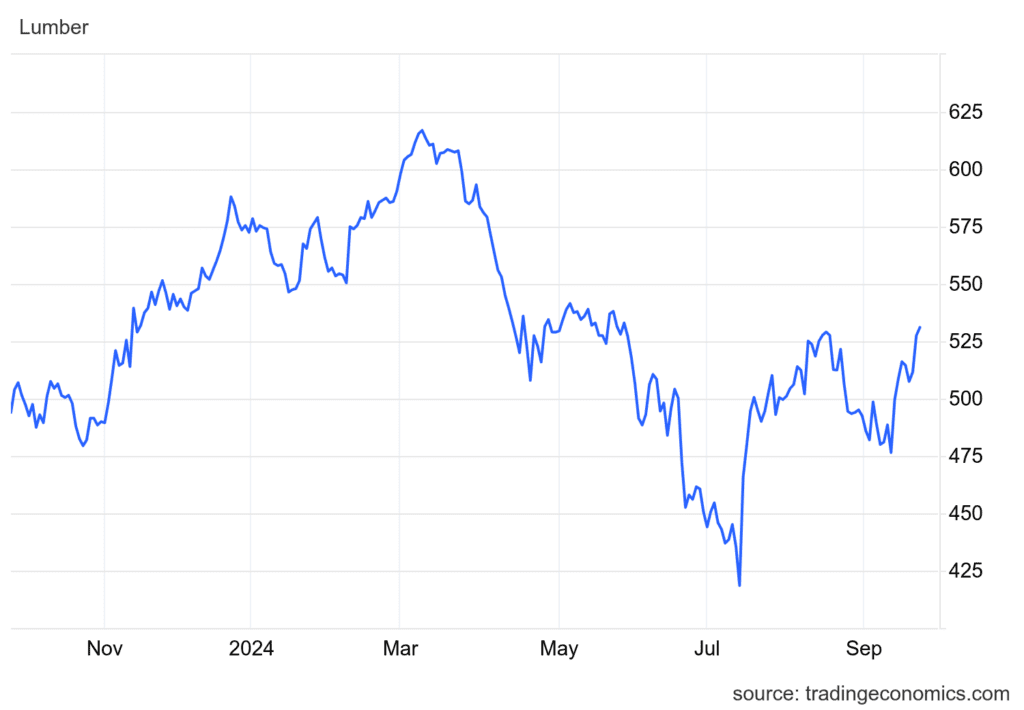

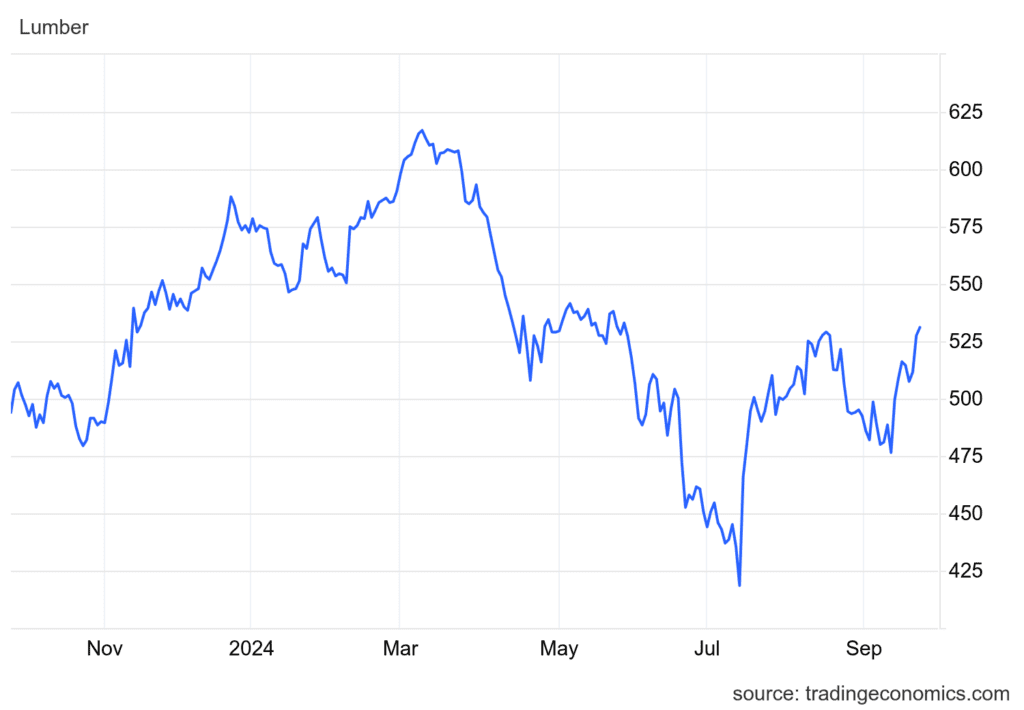

Lumbar Costs (October 2023 – October 2024)

*Years by USD/1,000 Board Ft.

Source: TradingEconomics.com

The graph above shows lumbar costs over the last 12 months. After falling mid-year, prices are increasing again after bottoming out around August.

Construction companies must stay informed about material prices so they’re able to estimate job costs and protect their revenue accurately. Timing projects around lower material prices can potentially bolster revenue. If costs are high, construction companies can also finance the purchase of these materials to stay cash flow positive, especially now that the Fed has begun to lower rates.

National Business Capital’s Construction Recap (September 2024)

Each month, we’ll offer our unique viewpoint on the construction industry’s short to mid-term outlook. Our insights come from a combination of available industry statistics, internal data, and the general sentiment of the construction clients we work with daily.

- 23.75% Increase in Construction Funding Volume – Construction companies accessed 23.75% more capital this month compared to August. Approvals are higher, and businesses are moving forward more confidently with financing offers. The continued growth of funding volume, as stated in our previous reports, is great news for the community.

- Construction Companies Are Confident in Their Plans – This month, we’ve noticed a considerable increase in construction companies planning their expansions. While we’ve seen some companies choose to wait on opportunities in the past, and even some now waiting to see the results of the election, decision-makers are starting to move forward more confidently.

- Mix of Business Activity Within the Industry – Northeastern construction companies have started to slow down their operations and prepare for the winter months, while companies across the southern states are gearing up for an increased workload.