Lime24 Loans Guide

Lime Loans South Africa (otherwise known as Lime24) is the sister company to the international FinTech company Lime Credit Group. They use advanced algorithms and machine learning capabilities to customise the loan application experience.

Lime is unique in that they offer discounts on their loans. Once you’ve paid off your first loan, you would be eligible to take out another one at a 25% discount on interest.

If you continue to repay your loan timeously, the discount on the interest rate would increase with each subsequent loan you take.

They’ve also created an affiliate program that offers financial rewards for referring your friends, family and colleagues who take out a loan.

- Founded: 2013, launched in South Africa in 2016

- No. of Staff: 501 – 1000

- Location: Headquartered in Hong Kong Island

South African office situated in Bedfordview - Valid Lending Licence: Registered Credit Provider that is regulated by the National Credit Regulator (NCRCP8077)

- How many loans have they processed: According to their website, they’ve served over 374 000 clients under the Lime Network

Loan Products

Lime Loans South Africa offers short-term loans that can be taken for a duration of 5 days (minimum) to 35 days.

Loan Amounts Available

With Lime24, you’re able to apply for a loan starting from R300, up to R 5400.

Due to the way they structure their rewards program to tie into your future loans, they have structured their loans as follows:

- Lime/Start: R300 – R1200

- Lime/Silver: R300 – R2100, with the service fee prorated based on loan term

- Lime/Gold: R300 – R3000, with lower interest rate from second loan onwards

- Lime/VIP: R300 – R5000, 5-day loans free of charge as well as the possibility to increase your borrowing limit (based on individual conditions)

Loan Terms Available

Lime Loans South Africa provides “pay-day” loans, which means you can choose to repay within 5 days or up to a maximum of 35 days.

Interest

It’s difficult to find direct info on interest numbers. Lime promotes their interest discounts more strongly, which are valid from the second loan onwards.

Repayments

Depending on what day of the month you accept the loan and for how many days you have taken it, they will raise a debit order for the agreed-upon date.

You can choose to repay your loan earlier by logging into your profile and clicking on the “repay” button. However, Lime Loans has advised against this if the next repayment date is within the following 3 business days, as the debit order will most likely still go through.

Fees

The way in which Lime Loans South Africa structures their interest discount makes it difficult to gauge their fees.

They have a sliding bar on their website that gives you an indication of your repay amount based on the amount and duration you choose.

However, until you create a profile, you will see the payment with the 50% interest discount included. Don’t be fooled – you can only qualify for this discount after having taken multiple loans out.

In order to get a proper breakdown of the fees for your specific loan, you will need to create a profile and apply.

Late Fee

If you miss a payment with Lime Loans South Africa, you will be charged a penalty fee in accordance with the Terms and Conditions of the loan. Interest will also continue to accrue from the original amount allocated to earlier tariffs, so the interest rate will not increase.

How To Apply For a Loan

Applying for a loan with Lime Loans South Africa takes three easy steps. From start to finish, the process takes about 10 minutes, including the money being sent to your account.

These are the steps to get started:

- Create your profile

- Complete your banking details (including a breakdown of expenses to identify your loan tariff)

- Withdraw your money (select the amount and term of loan, sign the agreement by clicking on the “I accept” button, and the money will be sent to your account)

You do have to agree to the Terms and Conditions of the loan and Debit Order Authorisation.

Approval is not guaranteed, as an individual’s affordability outcome is considered during the application process. This considers factors liker income and expenses, credit profile and previous payment behaviour.

Minimum Criteria to Take a Loan

To qualify for a loan, you will need to have the following:

- A cell phone number

- Your most recent payslip

- Bank statements

- A valid South African bank account

Information Required for Application

- ID number

- Employment information

- Monthly income

- Expenses

- Bank account information

Support Team Contact

The support team is very responsive and you can contact them telephonically or via email.

You can also use the self-service by logging into your profile on their website.

Social Media

Customer Reviews

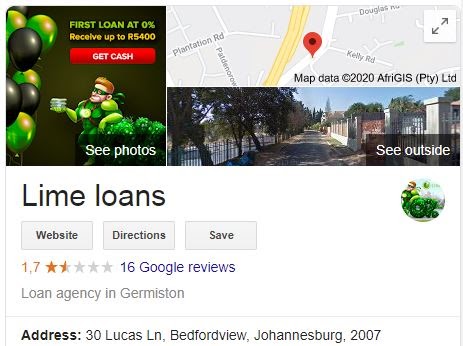

While there aren’t many reviews on Google, those that are there do not show the business in the most positive light. 16 reviews have averaged out to a rating of 1,7 out of 5, with 3 being 5-star reviews and the remaining 13 offering only a single star.

HelloPeter

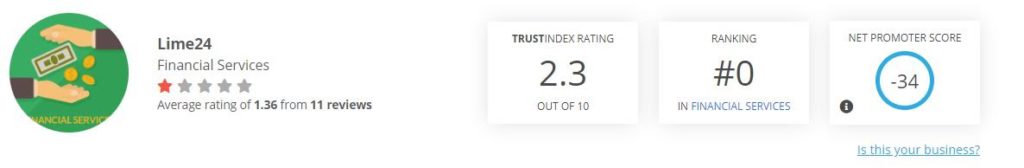

Lime Loans has two pages on HelloPeter, but unfortunately both show dismal star ratings and unhappy customers.

While the occasional positive review does make an appearance, the majority of recent feedback has shown the company in a negative light.

Average Star Rating:

We’ve calculated the average between Google Reviews and Lime24’s two ratings on HelloPeter.

Their average rating between these three is 1,5 stars out of 5.